150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower. The Child Tax Credit provides money to support American families.

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

In TurboTax Online to claim the Recovery Rebate credit please do the following.

. How Much Were the Child Tax Credit Payments Each Month. Here is some important information to understand about this years Child Tax Credit. The Child Tax Credit under the American Rescue Plan rose from 2000 to 3000 for every qualified child over the age of six and from 2000 to 3600 for each qualifying child under the age of six beginning in tax year 2021 the taxes you file in 2022.

And 3000 for children ages 6 through 17 at the end of 2021. Any remaining Child Tax Credit benefits will be paid when eligible parents and guardians. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18.

People who are eligible for a partial amount of Child Tax Credit. The amount of your Child Tax Credit will not be reduced if your 2021 modified adjusted gross income AGI is at or below. December 2021 based on the information contained in that return.

For the second phaseout in 2021 the child tax credit wont begin to be reduced below 2000 per child until your modified AGI in 2021 exceeds. Families with a single parent also called Head of Household with income of 200000 or less. The IRS will pay 3600 per child half as six monthly payments and half as a 2021 tax credit to parents of children up to age five.

How much is the Child Tax Credit for December. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. 3600 for children ages 5 and under at the end of 2021.

The credit was made fully. The IRS used the information from your 2019 or 2020 tax return to estimate your eligibility for monthly Child Tax Credit payments in 2021 and send payments equal to half of the amount of Child Tax Credit that the IRS estimated you would be able to properly claim on your 2021 tax return. You would be eligible to receive 1800 in 2021 and 1800 when you file your tax return.

Any advance child tax credit payments need to be reported on a 2021 IRS Tax Return. Eligible families can now apply for a one-time tax rebate to receive 250 for each child under age 18. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000.

The rebate caps at 750 for three kids. The advance Child Tax Credit payments were signed into law as a part of the American Rescue Plan Act in 2021. The credit amount was increased for 2021.

Heres who qualifies PDF. For example an unmarried taxpayer earning 210000 normally wouldnt receive a 2000 credit but rather 1500. Get your advance payments total and number of qualifying children in your online account.

2021 Child Tax Credit and Advance Child Tax Credit Payments Topic B. 112500 or less for heads of household. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

The credit is not a loan. Children under 6 years old qualify for the full enhanced Child Tax Credit of 3600 if their single-filer parent earns less than 75000 or their. Your newborn should be eligible for the Child Tax credit of 3600.

In total the expanded credit provides up to 3600 for each younger child and up to 3000 for each older one. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. Stimulus checks and the like helped minimize the Delta wave but.

Each qualifying household is eligible to receive up to 3600 for each child under 6 and 3000 for each child between 6 and 17. Married couples filing a joint return with income of 400000 or less. Enter your information on Schedule 8812 Form.

To reconcile advance payments on your 2021 return. The full credit is available for heads of households earning up to 112500 a year. Yes if your 2021 income is high enough the amount of Child Tax Credit you can claim will be reduced.

Among other changes the CTC was increased this year from 2000 per child to as much as 3600 per child as well as extended for the. December 15 2021. From July to December of 2021 eligible families received an advance child tax credit up to 300 per child under six years old and 250 for children between the ages of six to 17.

That comes out to 300 per month through the end of 2021 and. 400000 if married and filing a joint return. 75000 or less for singles.

Advance Child Tax Credit payment amounts are not based on the Credit for Other Dependents which is not refundable. How much is the Child Tax Credit for December. If you took advantage of the advance child tax credit payments in 2021 your family was allowed to receive 50 of your estimated credit from July through December.

For more information about the. We dont make judgments or prescribe specific policies. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Families with 17-year-old children will be eligible to claim the Child Tax Credit for the. Lets say you qualified for the full 3600 child tax credit in 2021.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. Parents with 2021 modified AGI no greater than 40000 single filers 50000 head-of-household filers or60000 joint filers wont. Eligibility for Advance Child Tax Credit.

Your newborn child is eligible for the the third stimulus of 1400. See what makes us different. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

200000 for all other filing statuses 9. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Families can receive half of their new credit between July and December 2021 and the.

The tool below is to only be used to help you determine what your 2021 monthly advance payment could have been. The amount of policy support we got in 2020 and 2021 was a massive amount said Jared Franz an economist at the Capital Group. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per.

To be eligible for the maximum credit taxpayers had to have an AGI of. These people qualify for a 2021 Child Tax Credit of at least 2000 per qualifying child. If you did not receive the stimulus for a dependent you can claim it on your 2021 tax return as the Recovery Rebate Credit.

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Child Tax Credit Definition Taxedu Tax Foundation

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

The Child Tax Credit Toolkit The White House

The Child Tax Credit Toolkit The White House

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

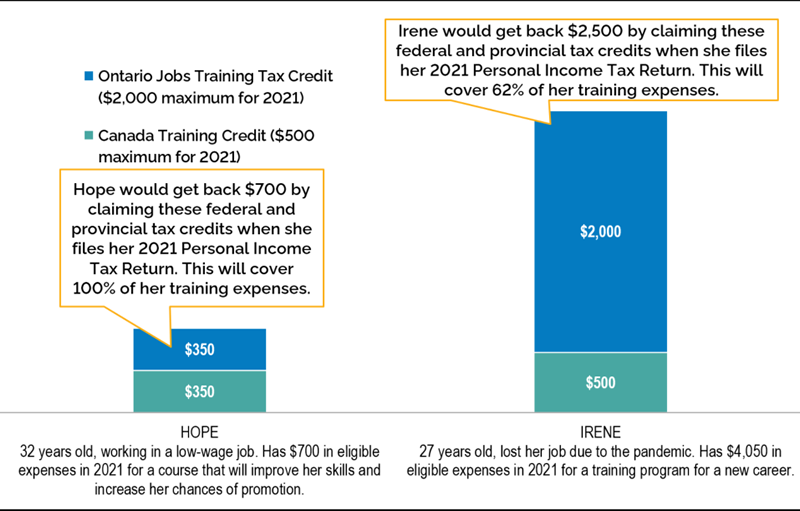

Ontario Jobs Training Tax Credit Ontario Ca

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Parents Guide To The Child Tax Credit Nextadvisor With Time

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Childctc The Child Tax Credit The White House

Tax Credit Definition How To Claim It

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities